No products in the cart.

Content

But things have changed a lot, and regulators are now the CFO’s main focus. Thanks to the Sarbanes-Oxley Act in the US and similar legislation in other countries, CFOs can now go to jail if they certify incorrect financial statements. On the other hand, if your company is in a tight spot from a cash point of view, the Treasury team will meet with the CFO daily to find solutions. If, at some point, you have no cash left and no credit line available, your company is dead. Why Treasury roles are crucial and why they can mean life or death for a company. When it comes to the CAIA exam, you want to know you’re preparing with quality materials.

Finance managers are there to manage cash and investments on the company level. And a crucial aspect of this role involves helping individual teams manage budgets. At one time, the CFO was simply the company’s highest ranking accounting and finance expert. They had very strong technical skills, and focused most on mitigating risk and ensuring compliance, and left much of the business strategy to other executives. Below is a glossary of job descriptions for accounting and finance teams. You’ll find common and valued positions, with definitions and descriptions of their core responsibilities.

What is the hierarchy of finance positions?

Similarly, if math was never your subject, it’s not a dealbreaker, but it is a skill you’ll need to practice regularly in this field. A career in finance is like the square and rectangle analogy — all industries involve corporate finance hierarchy financial jobs, but not all jobs must involve finance. In a typical finance team structure, the Chief Financial Officer heads the finance departments. The CFO is the highest-ranking finance officer in the company.

Is corporate finance same as FP&A?

The main divisions in the corporate finance career path are Financial Planning & Analysis (FP&A), Controllership, and Treasury. In FP&A, you create P&L forecasts, analyze performance against forecasts, and explain what caused variance.

They also help managers see how data-driven changes to products, process, services, software, and hardware can improve efficiency. But because corporate finance roles are spread across a variety of industries, it is unlikely to be automated out of existence or disappear during a down economic cycle. I am an MBA/MSF candidate at Boston College in corporate finance that is looking to transition to private equity. First, I wanted to let you know that this is by far the most helpful article I have read at outlining potential exit ops for corporate finance (and I’ve read, A LOT). Most articles about transitioning to PE or IB gloss over the corporate finance transition as one lump group of people, if even addressing them at all . Remember, in these roles, you’re “customers” are the internal management teams at your own firm.

#2 – Cost Analyst

Knowledge along with developing forecasting models for the projection of revenues and costs. It requires thorough commercial knowledge of real estate along with finance. Financial analysts also differentiate between projects depending upon their profitability.

Corporate finance professionals are often integral to the success of any business. As such, there will always be demand for individuals with the skills, qualifications and experience needed to fulfil the range of positions that come under the broad umbrella of corporate finance. Choosing to do the FRM qualification depends really on what career you’re in or would like to go into. It’s helpful for areas such as treasury, risk management, banking, and other roles where managing risk is an important part of the job. While this position may sometimes be considered below treasurers and controllers, it is mentioned in this hierarchy due to the often quite impressive salary that can be expected.

List of Top 9 Corporate Finance Career Paths

I am now working in the financial department as part of a restructuring team in a construction company. I was wondering what is best path to take after an MBA to become a CFO. I want to go for rotational program in a fortune 500 company. Both companies are in e-commerce related field; established with strong growth.

What are the different roles in corporate finance?

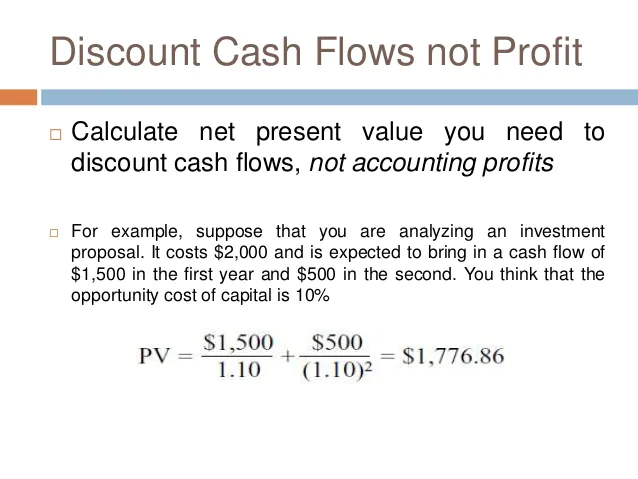

Corporate finance jobs tend to fall into three essential roles: capital budgeting, capital structure, and working capital management. Capital budgeting revolves around analyzing potential company projects that require significant investment.